Wisconsin and other states have incentivized farmland preservation to prevent residential and industrial development on agricultural land.

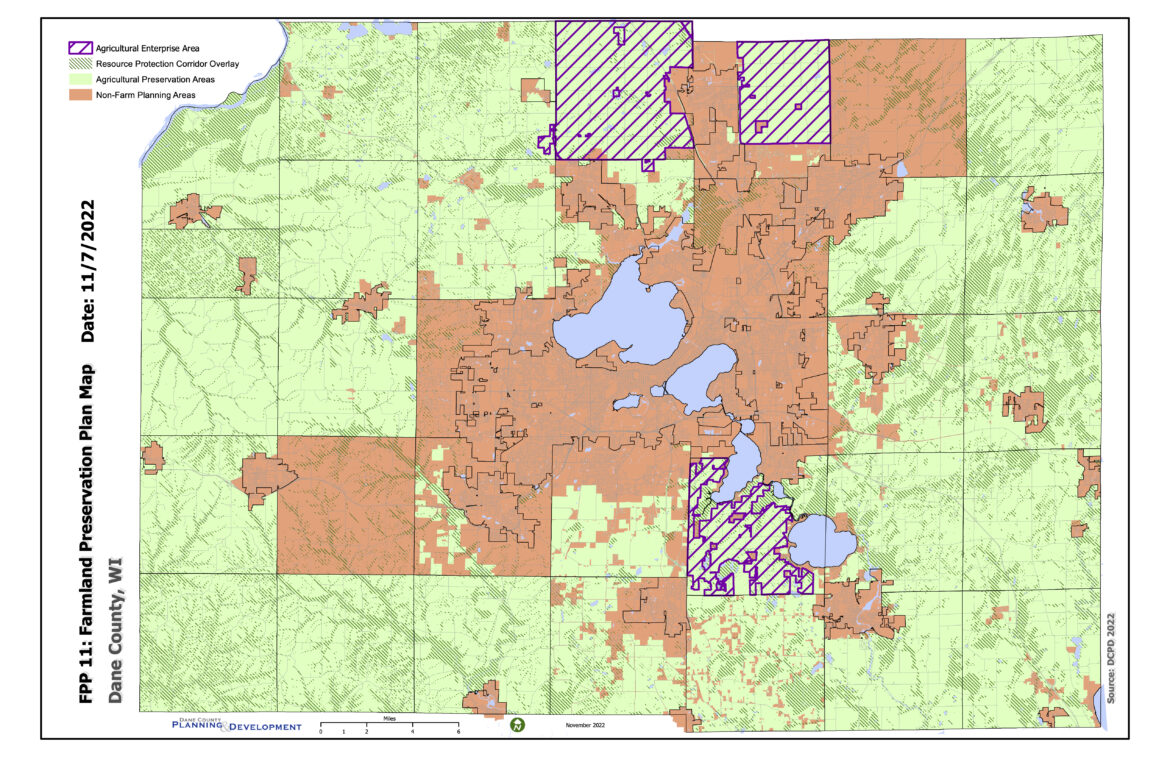

Wisconsin’s Farmland Preservation Program incentivizes preservation by helping counties provide landowners with tax credits. The program also develops preservation plans and preservation zoning districts, which are used to reserve designated land for farmland development, according to the Farmland Preservation Program website.

According to Andrew Stevens, assistant professor of agricultural applied economics at the University of Wisconsin-Madison, there is a concern that once agricultural land gets developed, it is essentially impossible for it to return to productive farmland. So, Wisconsin counties, including Dane County, want to preserve the best farmland through farmland preservation plans.

A farmland preservation plan is a nonbinding guidance document that counties use to examine the future of farmland. The Farmland Preservation Program, created by the state in 1978, certifies all the farmland preservation plans developed across different counties in Wisconsin.

“[The Farmland Preservation Program] works with Dane County as we would work with any county,” said Wednesday Coye, the Department of Agriculture, Trade, and Consumer Protection’s Farmland Preservation Program manager. “We are more than happy to sit down and meet with staff to talk about the planning criteria on things that are required for certification.”

Every 10 years, counties are required to recertify their farmland preservation plans with the state’s Farmland Preservation Program to meet certification standards under state law. Dane County’s Farmland Preservation Plan’s certification expires at the end of this year.

Brian Standing, lead staff for Dane County’s Farmland Preservation Plan, explained that Dane County’s new plan has recommendations and guidance for implementing solar farms, renewable energy generating facilities, and combating climate change. These types of reevaluations are also seen across different counties in Wisconsin. Every reevaluation is unique to adequately meet the needs of that community and county.

“You are seeing an increased interest in renewable energies, especially in more rural areas across the state,” Coye said. “So a lot more of our plans as they start coming through are talking about how they want to see how renewable energy systems incorporate into their communities.”

Recertification allows Dane County to implement new policies and tax relief to help the farmers and community. In 2012, the last time Dane County was recertified, farmers were receiving approximately $1.2 million in annual income tax relief and now are receiving around $1.46 million, the largest amount of any county in Wisconsin, according to Dane County’s farmland preservation plan draft for 2022.

“We are taking a much more in-depth look at the entire plan from beginning to end, making sure that things in place from 2012 are still relevant,” Standing said. “Where they are not [relevant], we are adding new policies to deal with emerging issues.”

Dane County’s ability to implement renewable energy through a farmland preservation plan is a major incentive for the county to participate in the Farmland Preservation Program.

“Many of our towns and villages within Dane County find the [Farmland Preservation Program] worthwhile because it makes farmers eligible for an income tax credit of $7.50 per acre per year in Dane County,” Standing said. “That works out to almost $2 million a year in income tax credits that go directly to farmers in Dane County.”

To obtain the tax credit, farmers must prove that they are complying with soil and water conservation standards that are important for water quality. The incentive-based aspect of the Farmland Preservation Program has had widespread positive effects on water quality in Dane County, according to Standing.

The tax credit amount per acre was last raised 11 years ago, around the time Dane County’s Farmland Preservation Plan was certified in 2012. In a Farmland Preservation Plan recertification survey, many farmers in Dane County said the tax credit was not a strong enough incentive since $7.50 per acre no longer covers the cost of managing soil and water conservation standards.

“Obviously with inflation the [tax credits] have not kept pace necessarily with the cost of compliance conservation standards,” Standing said. “We would very much like to see the state take a look at increasing [tax credits] so that they are at least high enough to cover the cost of complying with conservation standards. Ideally, we would like to get them pegged to inflation so they automatically increase over time.”

For the tax credit amount to change, an update to the law or a change of statute is needed.

“So if folks want to see that change, we encourage them to contact their local legislator and continue to write about it in their plan so folks can be aware that this is something that people are interested in,” Coye said.

Stevens’ research on the Farmland Preservation Program questions if the program truly incentivizes farmland preservation. He argues that there is no clear answer.

“In Dane County, I’m sure that we have landowners who have farmland reservation agreements with the government,” Stevens said. “It’s not clear to me that [landowners] did so because of the policy that the state passed or because they would have wanted to do something like that anyway.”